Draft | Unusual financial communication: Evidence from ChatGPT, earnings calls, and the stock market

封面来源:ChatGPT-4 DALL·E

摘要:ChatGPT的引入改变了人们处理文本数据的方式。本文为ChatGPT设计了一种提示策略(prompting strategy),用于识别和分析财务沟通中的异常之处,重点关注S&P 500公司的电话财报会议(earnings call)。利用最新的GPT-4-Turbo模型,从25个维度对异常财务沟通进行识别和分类,分为四类:高管的异常沟通、财务分析师的异常沟通、异常内容和技术问题。大部分电话财报会议存在异常财务沟通,这与公司的某些特征相关,并随商业周期波动。股市对异常信息反应消极,交易频繁。ChatGPT等大型语言模型具有金融分析潜力,可为解读复杂文本数据及其对市场影响的经济后果提供新的见解。

引用:Beckmann, L., Beckmeyer, H., Filippou, I., Menze, S., & Zhou, G. (2024). Unusual Financial Communication-Evidence from ChatGPT, Earnings Calls, and the Stock Market. Earnings Calls, and the Stock Market (January 15, 2024).

Introduction

Data

- Firms in the S&P 500 typically enjoy the largest following by financial analysts and reflect novel information sooner than smaller firms ($\color{blue}{Zhang,\ 2006}$).

- For smaller firms the data quantitiy and quality are much reduced and the price delay may be too large, obscuring the pricing channel in question ($\color{blue}{Hou\ and\ Moskowitz,\ 2005}$).

Contribution

- Engineer a suitable prompting approach for ChatGPT to identify and understand unusualness in earnings calls.

- Apply a three-step prompting strategy to identify unusualness in earnings calls (which is solely based on ChatGPT’s general knowledge and does not require an external definition of unusualness.)

- 向ChatGPT输入S&P 500公司的电话财报会议数据,输出”正常“或”异常“的结果并给出理由;

- Identify unusual financial communication in earnings calls and investigate its correlation with firm characteristics, industry affiliation, and macroeconomic indicators across various business cycles.

- Identify 25 dimensions of unusualness in earnings calls, which can be classified into four broader categories: unusual communication by executives, by financial analysts, unusual contents, and unusual technical issues.

- 具有异常沟通的公司往往规模更大,但利润较低,更有可能成为动量的输家;

- Relate the different dimensions of unusual communication to various macroeconomic indicators.

- Document that the degree of unusual communication varies with the business cycle.

- As our third contribution, we investigate to which extent market participants react to unusual earnings calls and if so, which dimensions of unusual communication are responsible for this reaction.

- Firms typically earn high returns on earnings announcement dates($\color{blue}{Savor\ and\ Wilson,\ 2016}$).

- Firms with unusual communication are significantly lower, and in fact indistinguishable from zero.

- This result stands both when value-weighting and equally-weighting the respective firms.

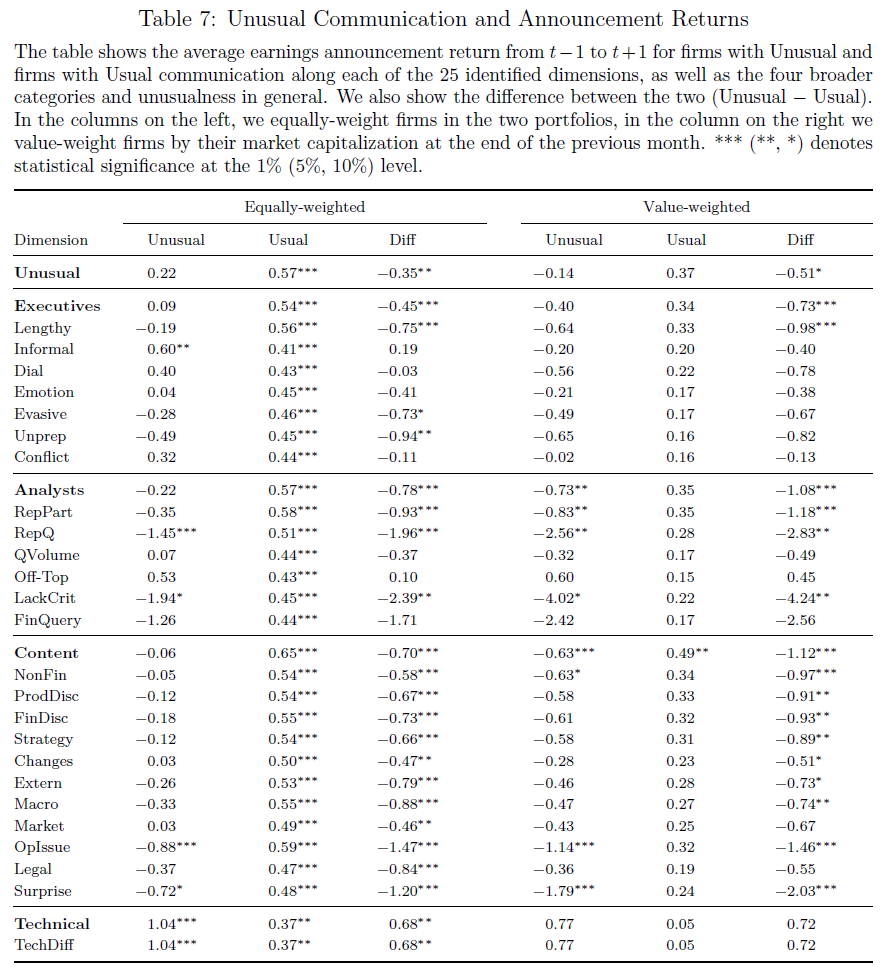

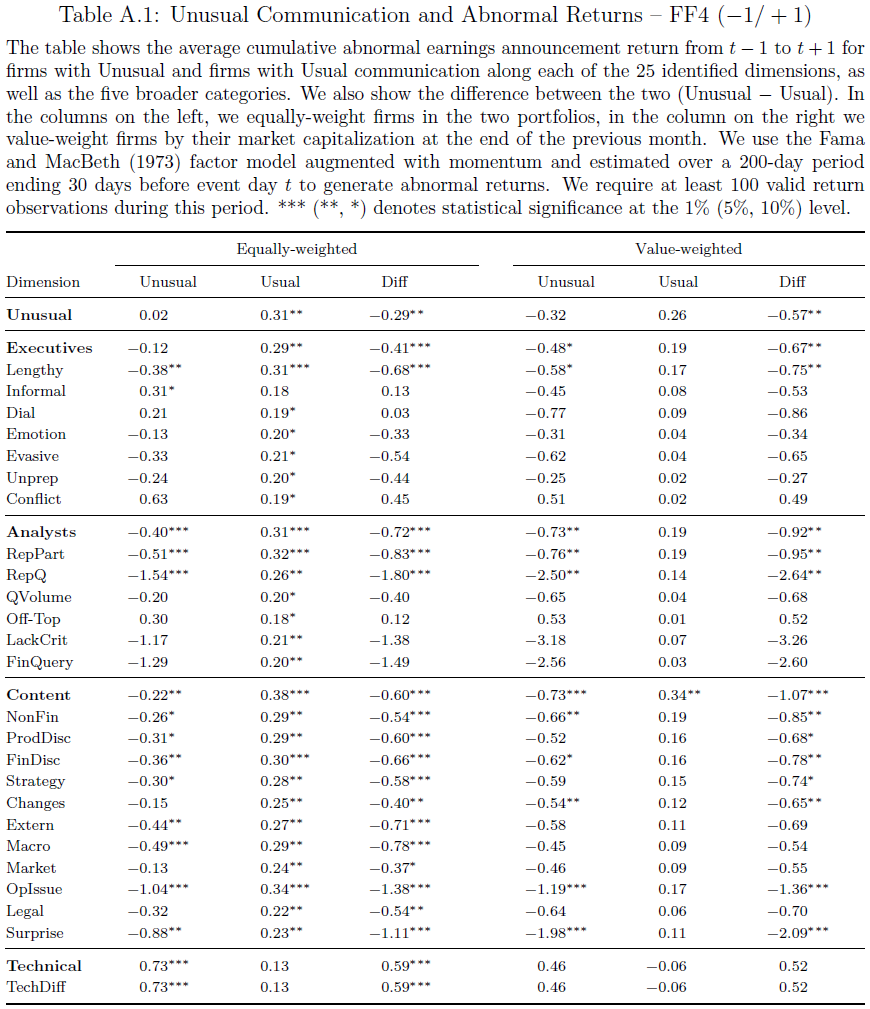

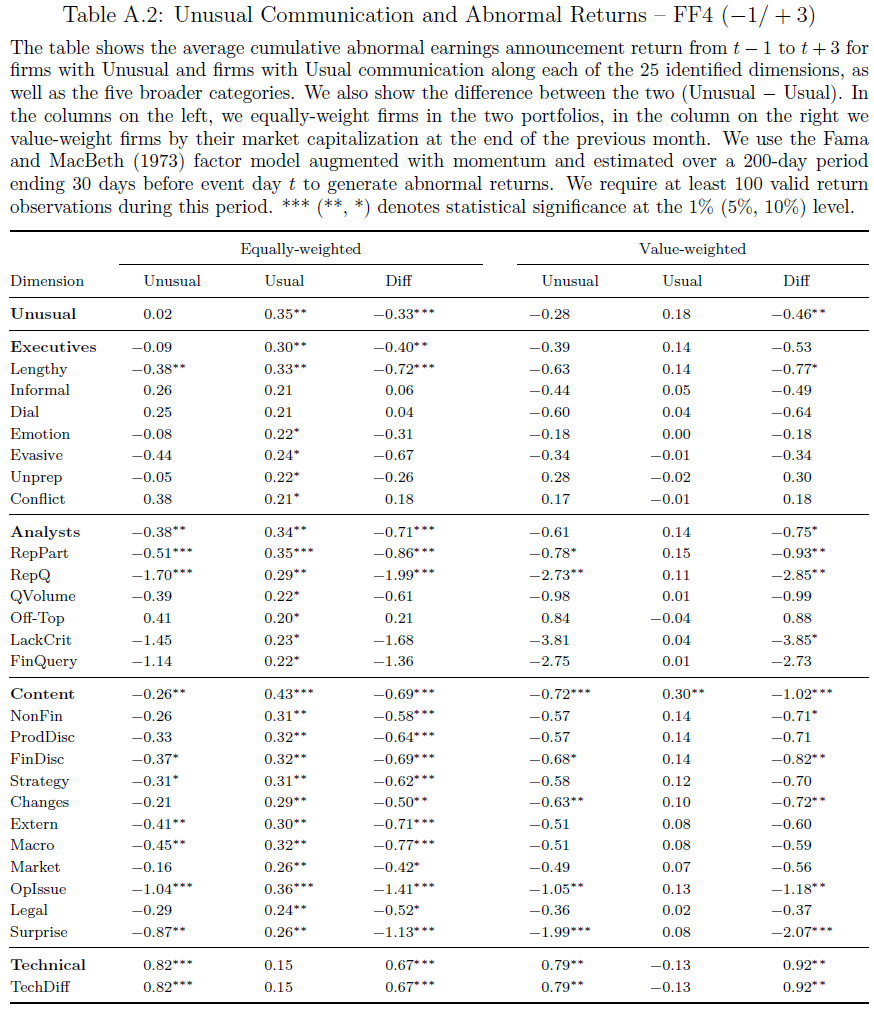

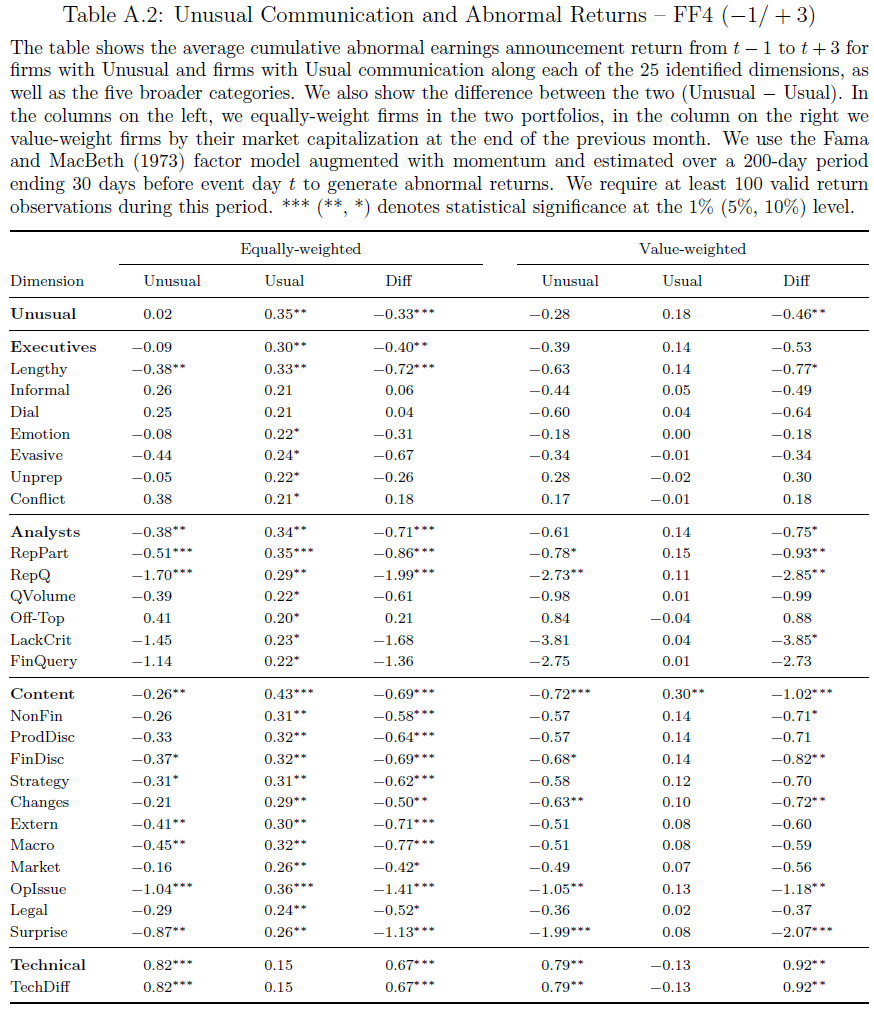

- Find large differences in the effects of the 25 dimensions.

- Technical difficulties are related to a positive return impact (equally-weighted) or no return impact (value-weighted).

- The largest negative return impact is produced by a lack of critical questioning by analysts (−4.24%), repetitive questions (−2.83%), or the announcement of surprising information (−2.03%).

Discover

Trading activity is significantly elevated for firms with unusual communication along many of the 25 identified dimensions.

- The literature has proposed trading volume as a measure for disagreement across investors.

- $\color{blue}{Hong\ and\ Stein\ (2007)}$argue that disagreement may arise when investors possess different information sets or if new information leads them to update their beliefs.

Find a negative and highly significant announcement return impact of unusual communication.

Advantage

- Rely on the same model for the decision of whether a particular earnings call was unusual or not.

- The model processes textual information significantly faster than humans, combines much of the aggregate reasoning while humans would process this information from its training corpus ($\color{blue}{de\ Kok,\ 2023}$).

- Utilize the most recent iteration of ChatGPT, known as GPT-4-Turbo, which can process texts of up to 128000 tokens in a single prompt.

Methodology

Data Description

Object: Firms in the S&P 500

Presentation

Q&A session※

.txt files

the date and time of when the earnings call took place

- the reporting quarter

- the company name and ticker

- feed ChatGPT with the Q&A session only

Data sources: Refinitiv

Sample period: 2015.01: 2022.12

Accessing ChatGPT: Access GPT-4-Turbo via its application programming interface (API).

- an updated version of GPT-4

- released on November 6, 2023

- token limit has been increased to 128000

Prompt Engineering

three-step prompting approach(了解电话财报会议是否异常以及异常特征):

第一步,随机向ChatGPT提供2015年至2023年间1000份问答会话记录的样本,并要求该模型判断某个问答会是否异常,如果存在异常则提供文字说明。

1

Prompt 1: Please read the following transcript of a Question-and-Answer session from the earn-ings conference call of company {firm} ({ticker}) carefully. Determine whether the Question-and-Answer session of this earnings conference call is ‘usual’ or ‘unusual’: If the Question-and-Answer session is classified as ‘usual’, state ‘usual’ without any justifications or further output. If the Question-and-Answer session is classified as ‘unusual’, state ‘unusual’ and provide a justification for this classification. Transcript of the Question-and-Answer Session: ‘{qa}’.

第二步,将异常结果系统化。收集第一步中的异常理由,并提供给新prompt,令ChatGPT从中归纳出高层次类别。

1

Prompt 2: Please read the provided text file with justifications for unusual Q&A sessions from earnings conference calls carefully. What are high-level categories to identify unusual Q&A ses-sions? Make sure that each statement from the text file can be assigned to one of the categories.

第三步,检查以上维度的所有异常问答。

1

2Prompt 3: Please read the following transcript of a Question-and-Answer session from the earnings conference call of company {firm} (ticker) carefully. Determine whether the Question-and-Answer session of this earnings conference call is ‘usual’ or ‘unusual’ in the following {len(categories)} categories: {categories}

For each category, state whether the Question-and-Answer session is ‘usual’ or ‘unusual’. If the Question-and-Answer session is classified as ‘usual’ in the respective category, state ‘usual’ without any justifications or further output. If the Question-and-Answer session is classified as ’unusual’ in the respective category, state ‘unusual’, print a ‘/’, and provide a justification for this classification. Transcript of the Question-and-Answer Session: ‘{qa}’- 以特斯拉2018年第一季度电话财报会议中的异常沟通为例。

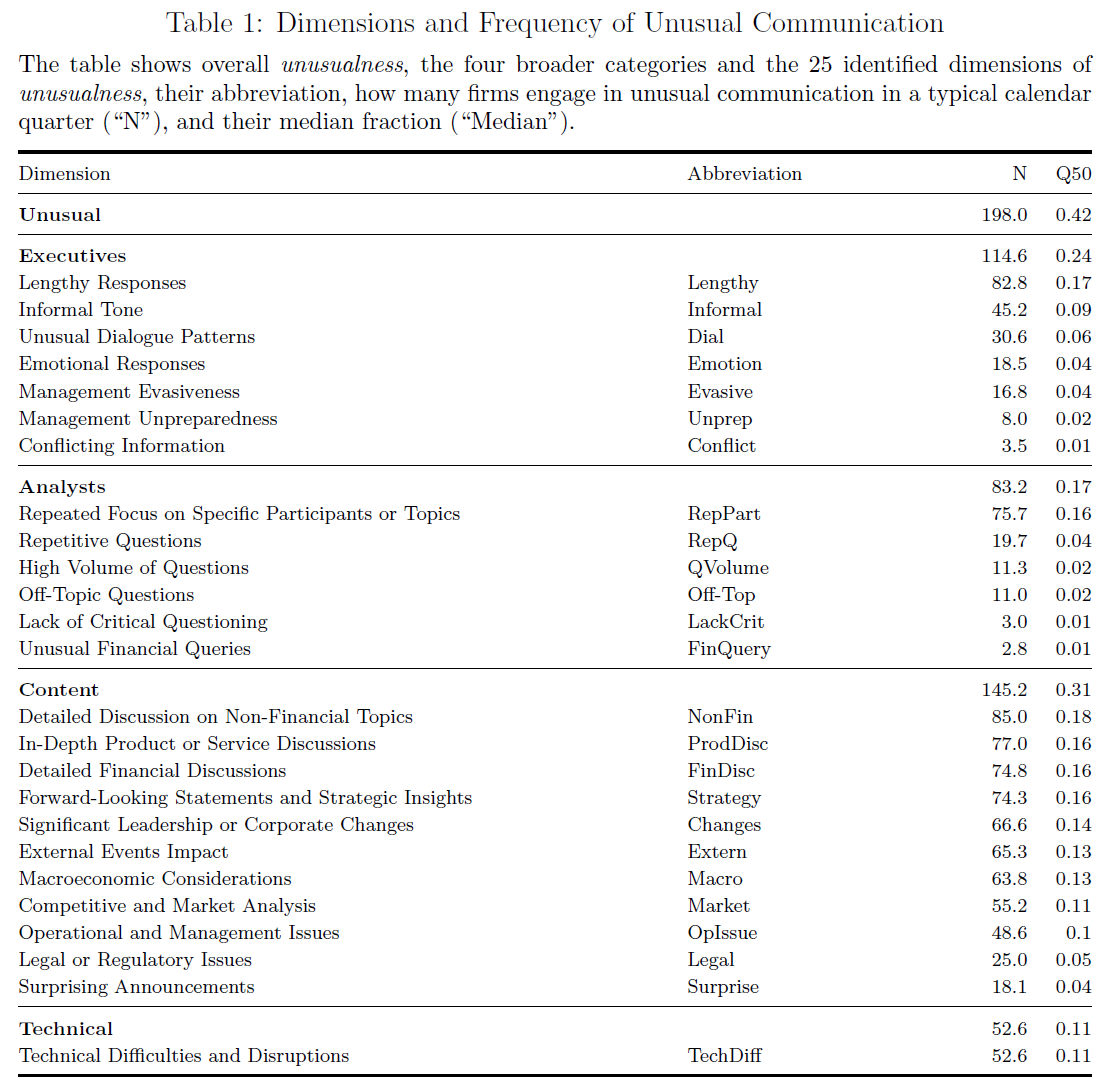

- 表1概括了异常沟通维度,ChatGPT提供25个high-level categories,且降维至四个维度:

- 管理层沟通异常:指的是公司管理层在回答分析师提问时表现出的异常行为,如回答过于冗长、情绪化,或者含糊其辞、逃避问题,甚至出现自相矛盾的情况,显露出管理团队可能没有充分准备;

- 分析师互动异常:包括分析师提出的问题离题或重复、问题数量异常多、反复关注特定参与者或议题、频繁询问与财务无关的问题,以及缺少对关键问题的探讨;

- 沟通内容异常:涵盖公司变革、领导层变动、战略洞察、法律与监管议题讨论、运营和管理问题、对其市场行为的分析、对特定(财务或非财务)主题的详细讨论、外部事件的影响、宏观经济因素和公告等,以及对公司产品或服务的深入讨论;

- 技术难题:识别在沟通过程中遇到的技术执行或操作问题,可能会影响到信息或数据传输的准确性。

ChatGPT优势

- 可复现性;

- 解释文本信息速度更快、结合了更多信息;

- 优于人工方法或者LM词典;

Identifying Unusual Communication

异常交流频率

表1展示了异常沟通频率。

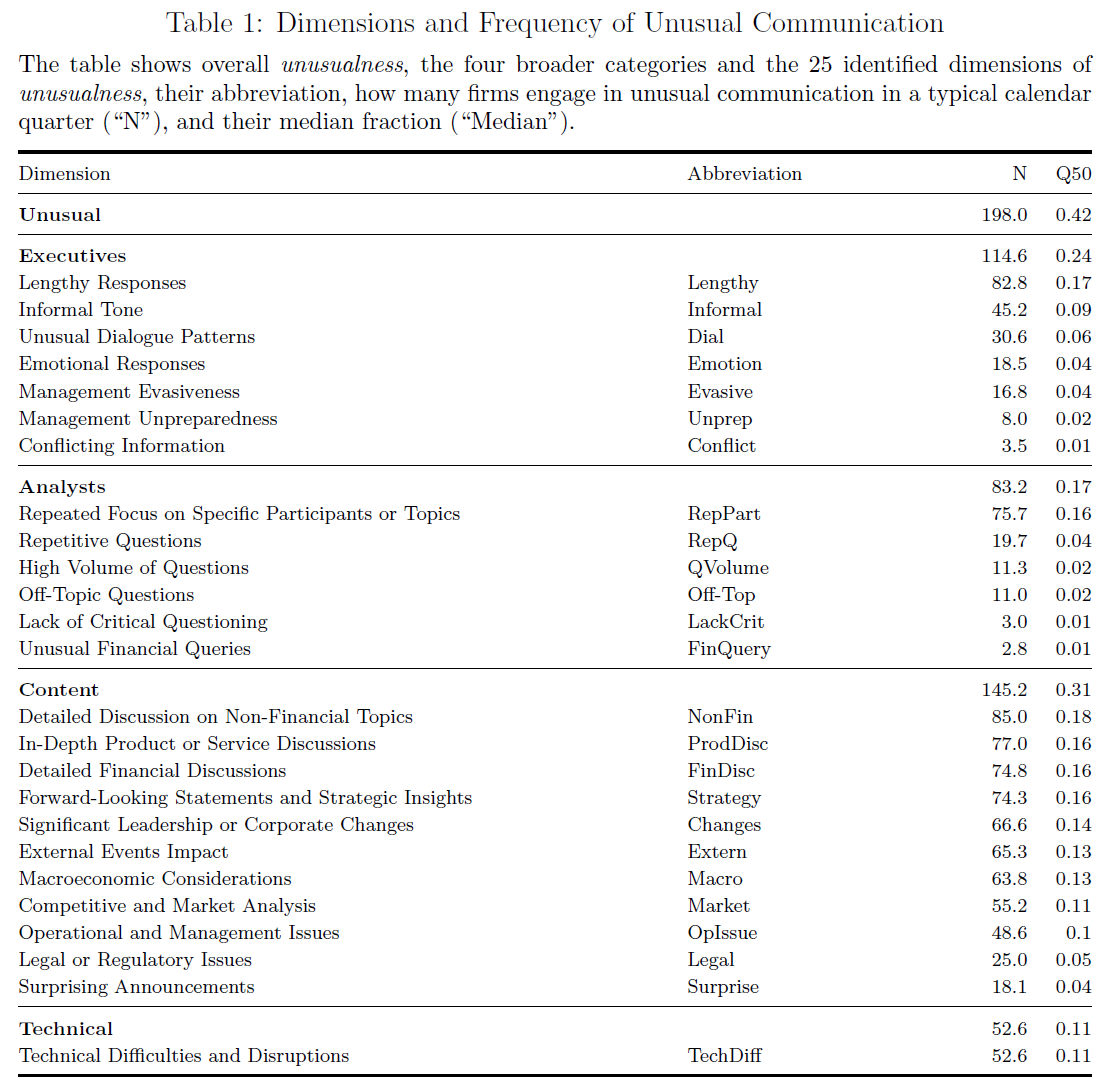

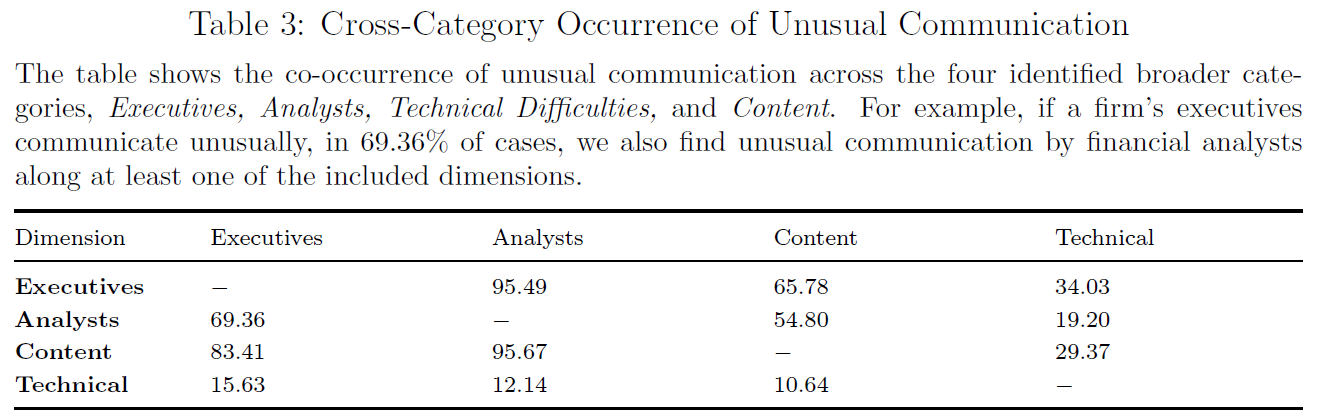

表2表明在某一维度上存在异常沟通的公司,在同一类的另一维度上也存在异常沟通可能性有多大。

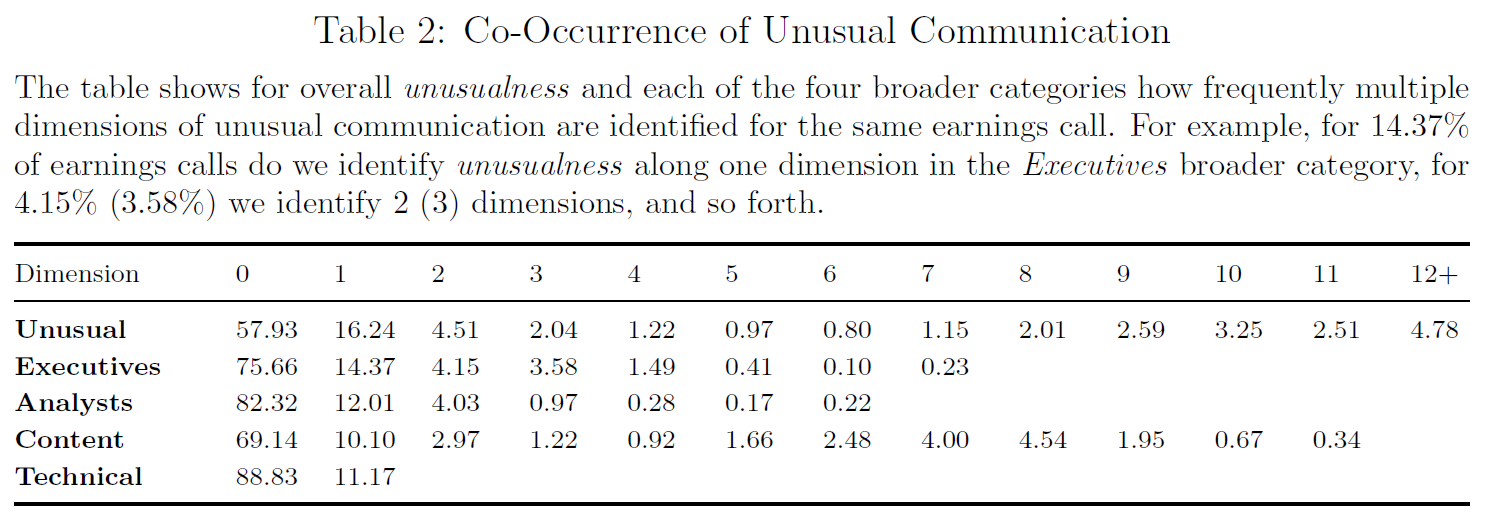

表3说明在某一类别(高管)的至少一个维度上存在异常交流的公司,在另一类别(分析师)上也出现异常交流迹象的频率。

- Financial analysts are important to set the tone of the discussions during the earnings call.

表1至表3可得:异常沟通模式存在较大的异质性。

异常公司

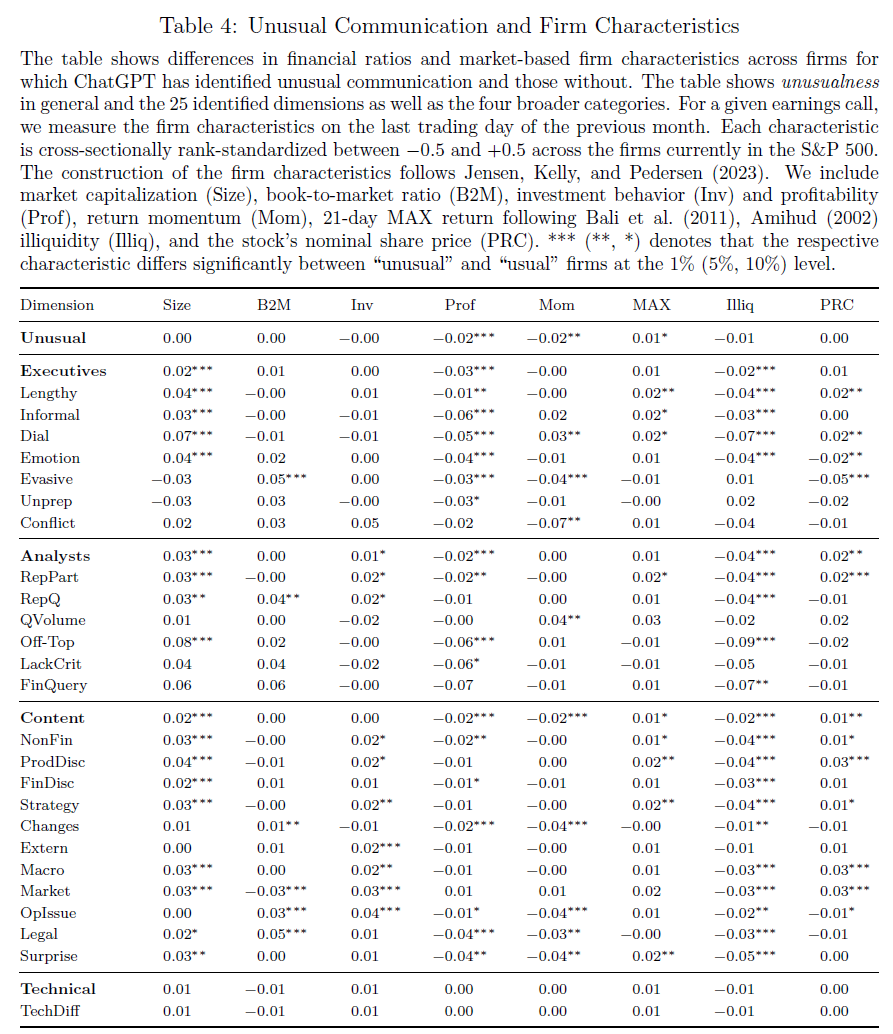

表4为异常沟通与公司特征的关系。

- 表4整体介绍

- 通过比较在4类别的25个维度,查看存在异常沟通与否,公司在财务比率和公司特征方面是否存在系统性差异,进而分析特定公司是否更容易出现异常沟通;

- 考虑如下因素:市值(Size)、账面市值比(B2M)、投资行为(Inv)、盈利能力(Prof)、动量(Mom)、21天最大收益率(MAX)、流动性(Illiq)和名义股价(PRC);

- Prof(-2%):即存在异常沟通公司的盈利能力平均低2%;

- 高管异常沟通

- 存在高管异常沟通的公司盈利能力(Prof)明显较低、平均规模(Size)略大,股票流动性(Illiq)略高;

- 高管异常沟通的不同维度存较大异质性;

- 分析师异常沟通

- 公司市值(Size)较大、投资额(Inv)略高但盈利能力(Prof)较低、$\color{red}{股票流动性(Illiq)较强}$、交易价格(PRC)较高有关;

- 技术难题

- 与公司特征无关;

- 以上说明:ChatGPT可以从电话财报会议记录中识别出异常沟通对应的意义。

- 沟通内容异常

- 股票平均规模(Size)较大,盈利能力(Prof)较差 ,动量(Mom)输家、股票流动性(Illiq)更强,交易的名义价格(PRC)更高。

- 讨论法律问题(Legal)的公司往往是价值股,账面市值比高;

- 宣布意外消息(Surprise)和公司或管理层变动(Changes)的公司更有可能是动量(Mom)输家,表明其以往股票收益率已低于同行;

- 存在Legal、Surprise和Changes等维度异常沟通的公司盈利能力(Prof)较差;

- 表4整体介绍

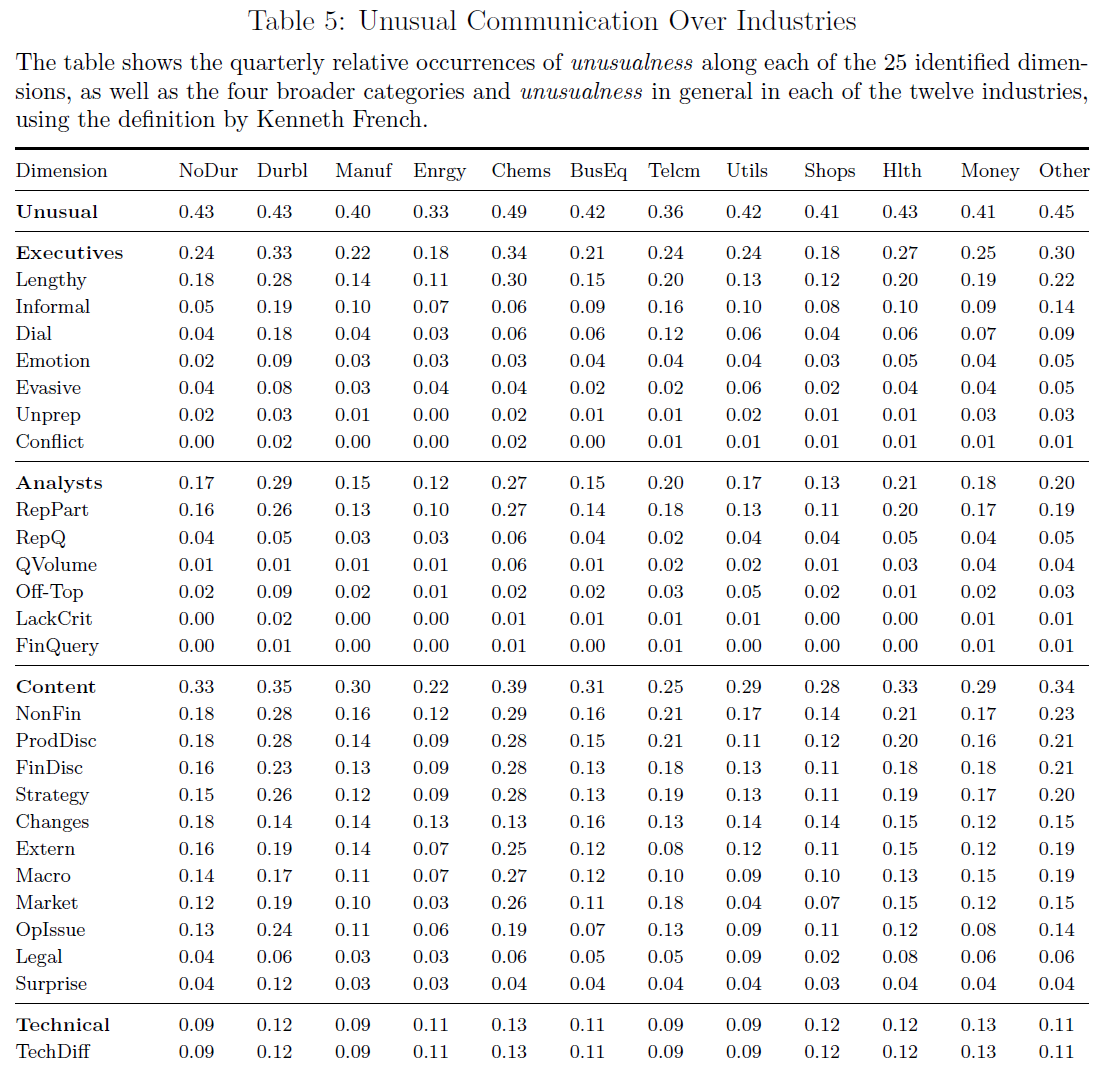

表5展示了不同行业的企业是否在异常沟通倾向方面存在系统性差异。

- 步骤:收集样本中各公司的SIC,根据$\color{blue}{Kenneth\ French}$的定义将其归入12个行业之一;

- 异常沟通与公司行业归属基本无关,即异常沟通并非某些行业独有;

异常沟通时期

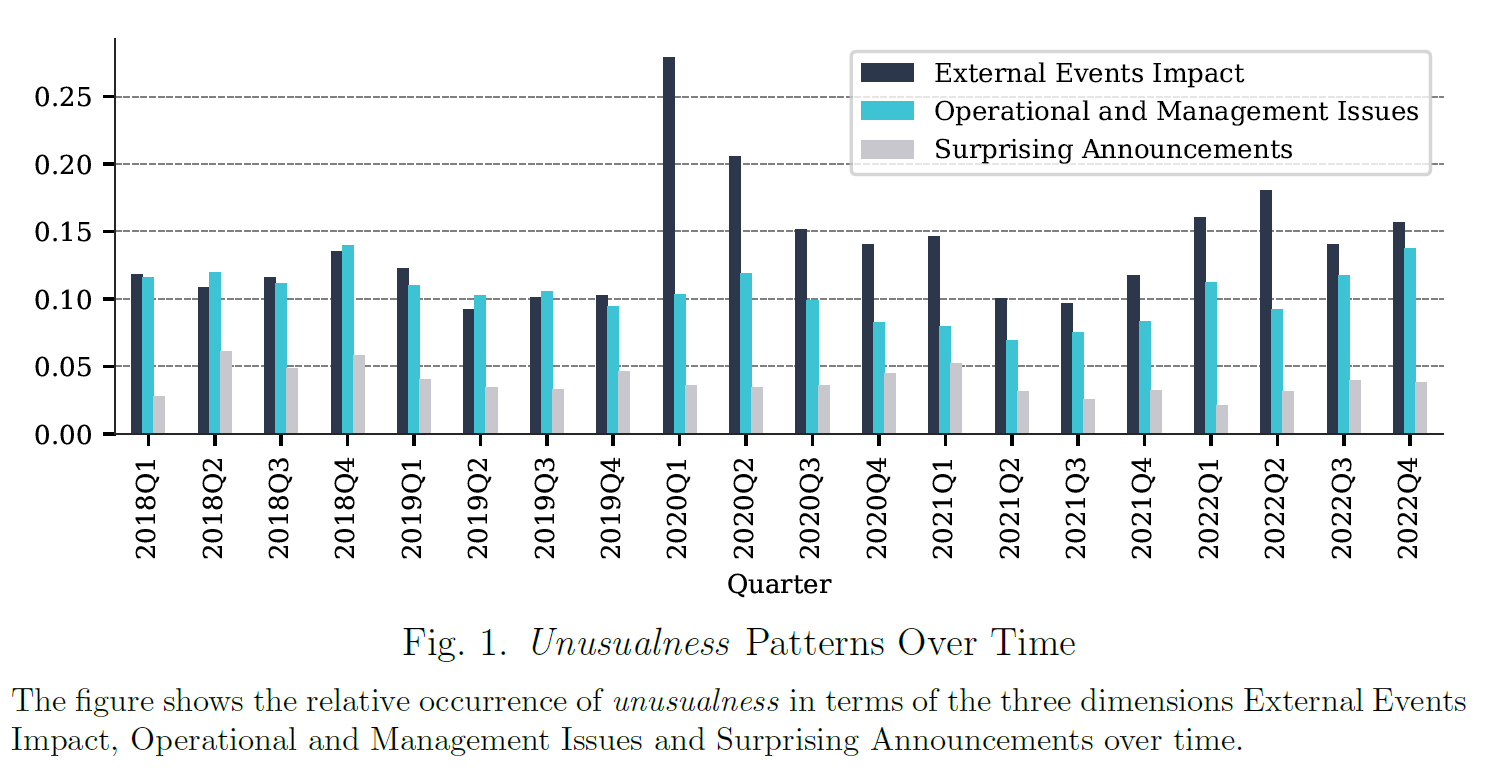

图1显示了随时间推移,外部事件影响(External Events Impact)、运营和管理问题(Operational and Management Issues)以及意外公告(Surprising Announcements)等三方面异常沟通的相对发生率;

- 外部事件影响(External Events Impact)

- 2018-2019年约为10%,在2020年Q1达到峰值,超过 25%(即四分之一的企业讨论了外部事件的影响,主要是Covid crisis);

- 【Interestingly, however, ChatGPT considers the communication style with this regard of only 1/4 of all firms as unusual.】

- 2022年初再次达到峰值(俄乌战争);

- 运营和管理问题(Operational and Management Issues)

- 平稳

- 意外公告(Surprising Announcements)

- 2018年、2021年Q1达到高峰;

- 外部事件影响(External Events Impact)

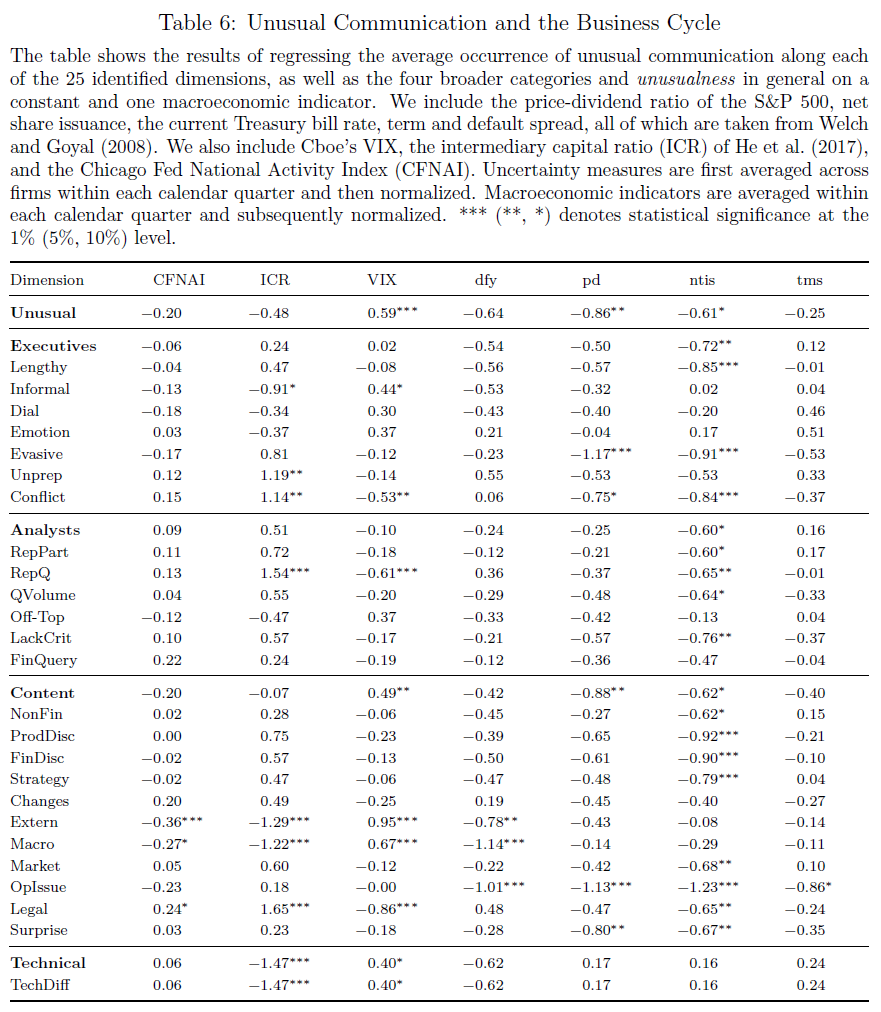

表6揭示了异常沟通与商业周期的关系(单变量回归)。

- 宏观经济指标

- 标准普尔 500 指数的市盈率(the price-dividend ratio of the S&P 500)、股票净发行量(net share issuance)、当前国库券利率(the current Treasury bill rate)、期限(term)和违约利差(default spread)($\color{blue}{Welch\ and\ Goyal,\ 2008}$);

- VIX;

- intermediary capital ratio(ICR)($\color{blue}{He\ et\ al.,\ 2017}$);

- 芝加哥联储全国活动指数(Chicago Fed National Activity Index,$\color{blue}{CFNAI}$);

- 结果分析

- 宏观经济指标

Stock Market Reaction to Unusual Communication

计算步骤

- 采用每日股价,计算事件发生日$t$与前后一天($t-1$、$t+1$)时间窗口内累计收益率;

- 分别计算4类、25维度异常沟通的等权、加权收益率;

表7表明了异常沟通与公告收益的关系。

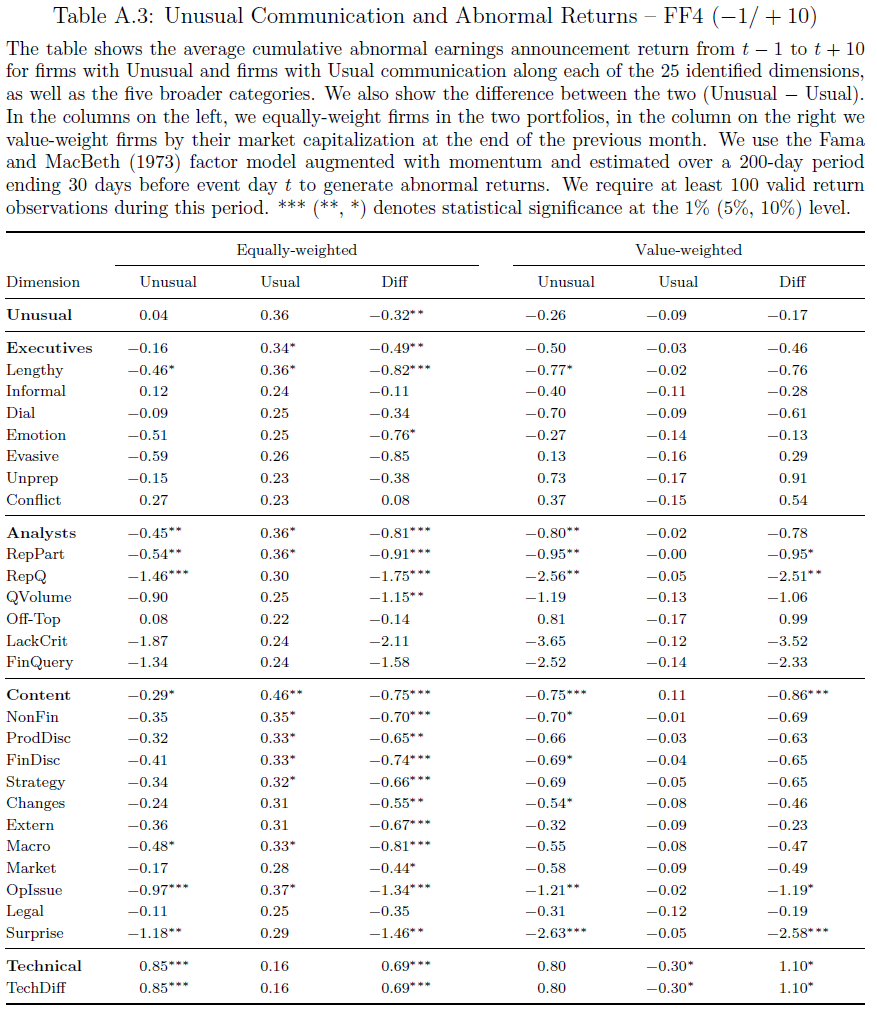

异常沟通与较低的公告收益率相关,正常沟通收益为正($\color{blue}{Savor\ and\ Wilson,\ 2016}$),异常沟通收益率无异于零;

公司高管异常沟通与显著较小的公告收益有关(等权、加权均适用);

分析师异常互动与负收益显著相关;

异常内容产生显著较小的公告收益;

更换计算累计异常收益方法:$\color{blue}{Fama\ and\ French\ (1993)}$

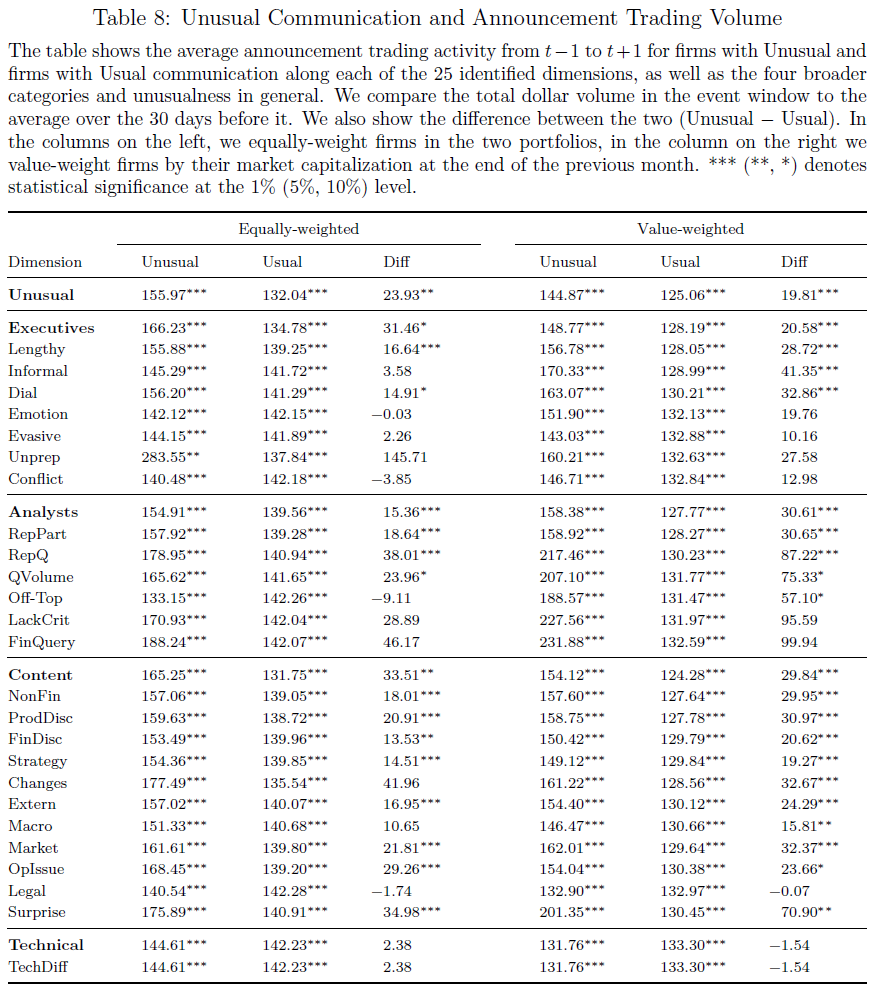

表8表明异常沟通导致交易频繁。

- 异常沟通交易量显著增加;

- 分析师对特定主题或参与者的反复关注,以及重复提问和大量提问,均导致交易量显著增加;

- 技术困难不会使交易量增加,即异常沟通交易量增加是由于投资者对信息存在分歧;

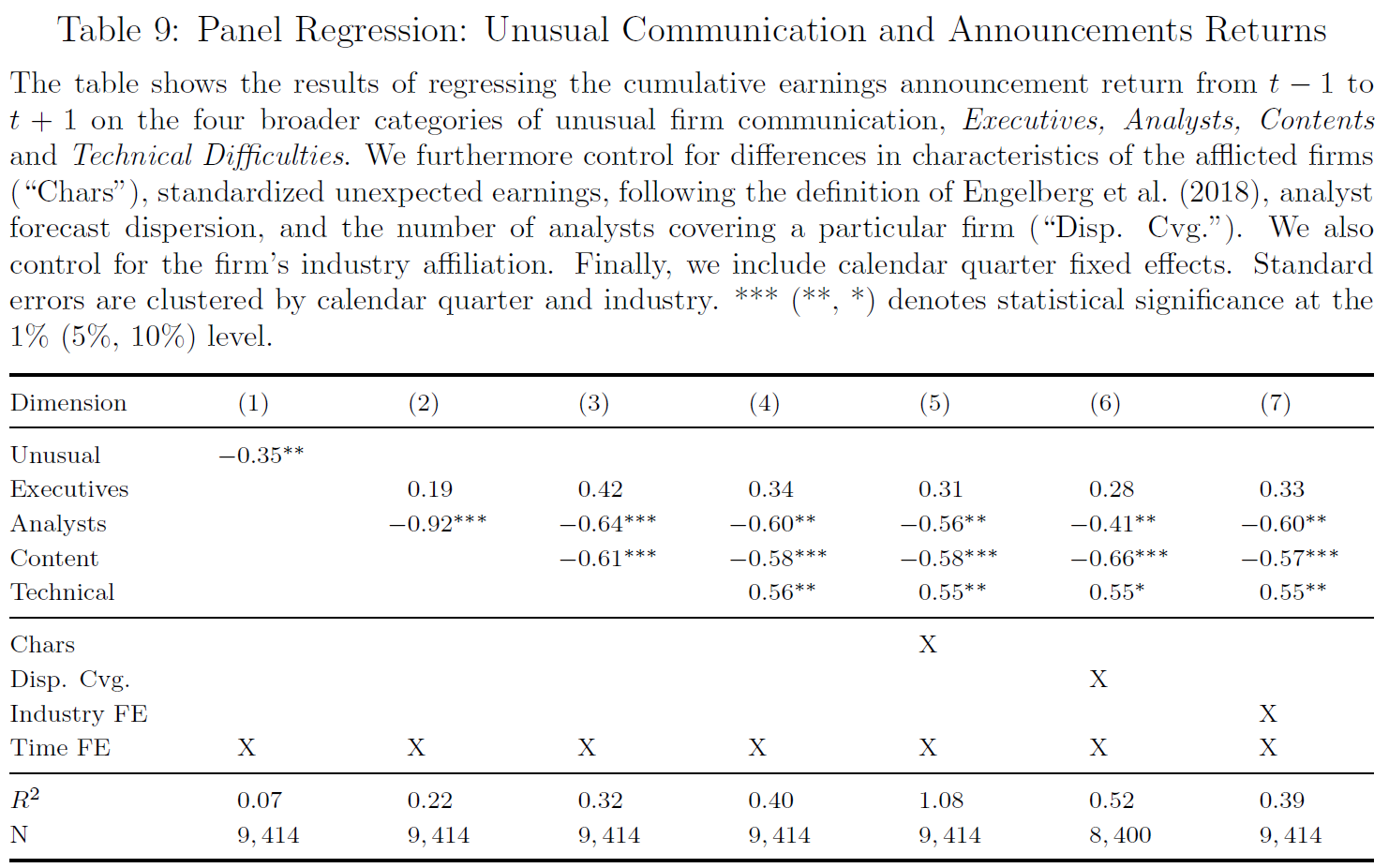

表9面板回归。

- 异常沟通导致公告收益下降35个基点;

- 技术困难对收益率存在正向影响;

- 异常沟通与异常内容都和公告收益率大幅下降相关;

- 加入SIC行业固定效应,各类异常沟通系数几乎不变。