Journal | JFuM | Anger in predicting the index futures returns

封面来源:ChatGPT-4 DALL·E

摘要:本文旨在研究不同情绪如何影响指数期货收益。采用滞后的基于文本的情绪(愤怒、喜悦、恐惧、乐观和悲观)指数对预测标普500指数期货收益的预测回归进行了检验,发现悲观和乐观情绪指数之间存在不对称的预测能力。研究表明,只有基于文本的愤怒指数能可靠地预测指数期货的样本内收益率,并在样本外优于无条件平均值。值得注意的是,在控制了其他情绪指数、投资者情绪指数和已知可预测期货市场的基本变量后,基于文本的愤怒指数的预测能力依然存在。以基于文本的愤怒指数为条件的资产配置可以产生巨大的经济效益。此外,愤怒指数还通过贴现率和现金流两个渠道影响股指期货收益率。

引用:Cao, Z., Shen, J., Wei, X., & Zhang, Q. (2023). Anger in predicting the index futures returns. Journal of Futures Markets, 43(4), 437-454.

Keywords: anger, emotions, index futures return predictability.

Introduction

引出话题

(1)情绪与资产定价、解释定价错误($\color{blue}{Brown\ and\ Cliff,\ 2004}$; $\color{blue}{Neal\ and\ Wheatley,\ 1998}$; $\color{blue}{Stambaugh\ et\ al.,\ 2012}$);

(2)投资者受情绪影响($\color{blue}{De\ Long\ et\ al.,\ 1990}$)【不同于传统理性预期假说,噪声交易者对非基本面信号采取行动,投资者情绪波动会导致市场价格偏离其基本面价值】;

(3)投资者情绪指数($\color{blue}{Manela\ and\ Moreira,\ 2017}$; $\color{blue}{Baker\ and\ Wurgler,\ 2006}$; $\color{blue}{Huang\ et\ al.,\ 2015}$),通过不同方式构建,并从理论和实证上阐明了投资者情绪如何影响股票市场;

(4)现有指数较为单一,其他情绪($\color{blue}{Bodenhausen\ et\ al.,\ 1994}$; $\color{blue}{Griffith\ et\ al.,\ 2020}$; $\color{blue}{Shen\ et\ al.,\ 2023}$)【愤怒与市场的均值-方差风险厌恶和未来市场收益有关;恐惧、喜悦、悲观和压力指数对股票市场和债券市场的预测能力】;

(5)$\color{blue}{Han\ et\ al.(2022)}$期货市场通过提供全市场信息并在价格和回报方面引领现货市场,在全球市场中发挥着重要作用。→→→投资者情绪波动会影响规避风险的投资者对现货市场(如股票市场)的偏好,也可以传达大量信息,拉低或提高投资者对期货市场的需求;

贡献

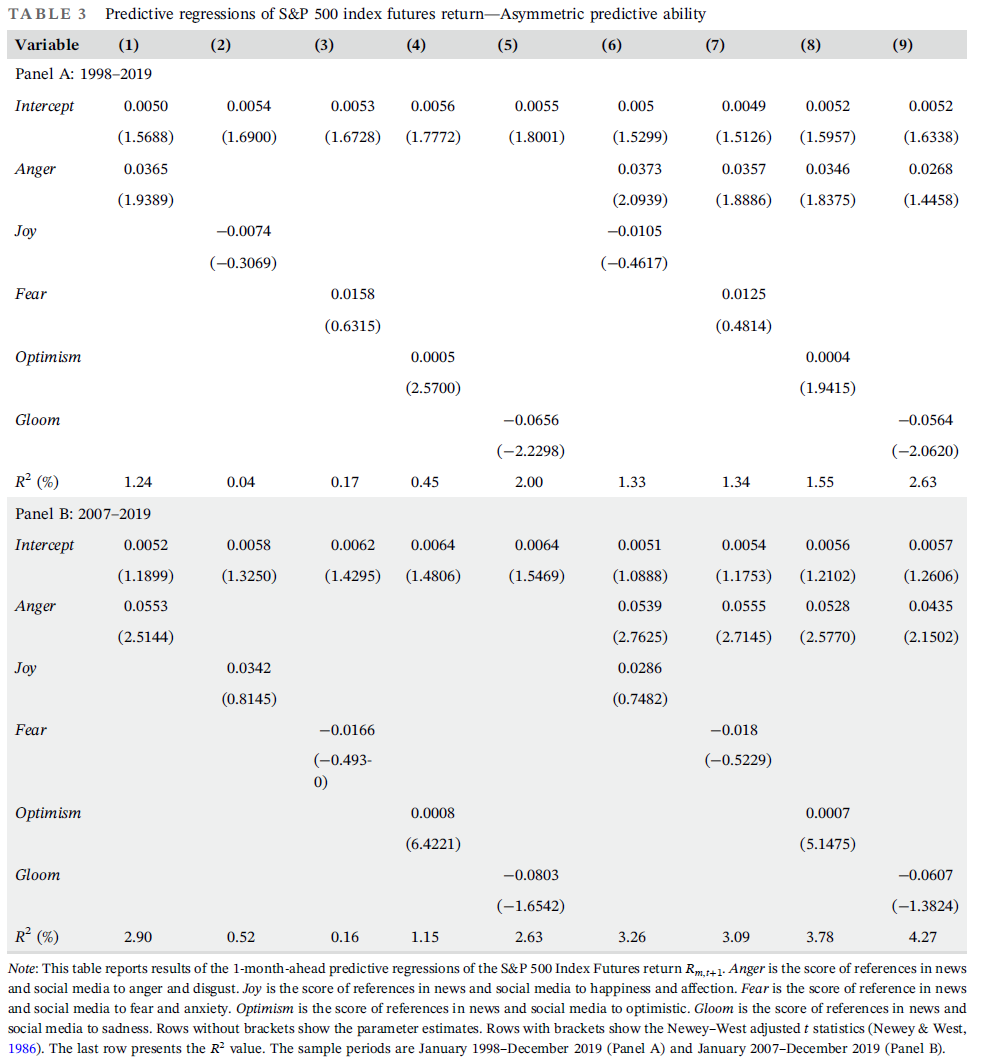

(1)将整体投资者情绪划分为多维度,揭示多维投资者情绪对期货市场的不对称可预测性;【anger、fear和gloom代表消极情绪,joy和optimism代表积极情绪。消极情绪显著可预测性,积极情绪的几乎无可预测性,即不对称的可预测性。($\color{blue}{Smales\ (2014)}$投资者在消极情绪下表现出更多非理性,需要更高风险溢价)】

(2)为数不多研究投资者情绪与股指期货收益率之间联系的研究者,并揭示了愤怒在期货市场中的重要性【第一篇实证论文证明愤怒指数传达了关于期货市场的有价值的信息,样本内和样本外均带来正向收益】;

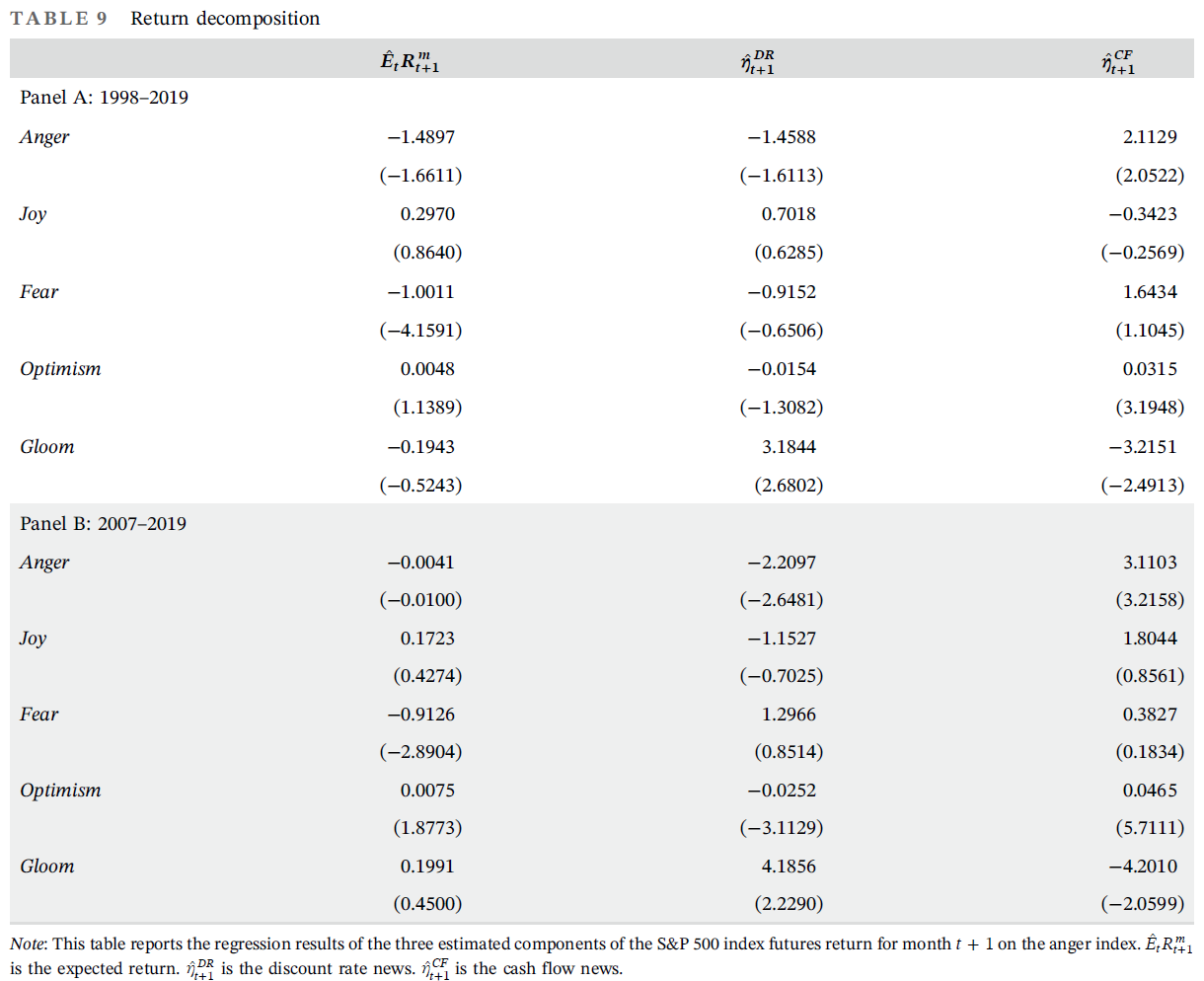

(3)首次探讨愤怒指数预测能力的微观经济mechanism【利用VAR模型阐明愤怒指数通过贴现率和现金流channels影响指数期货收益】;

Data and measuring anger

数据:Datastream数据库的S&P 500 Index Futures日度简单收益(1998.01-2019.12),$R_{m,t}$表示月度收益;

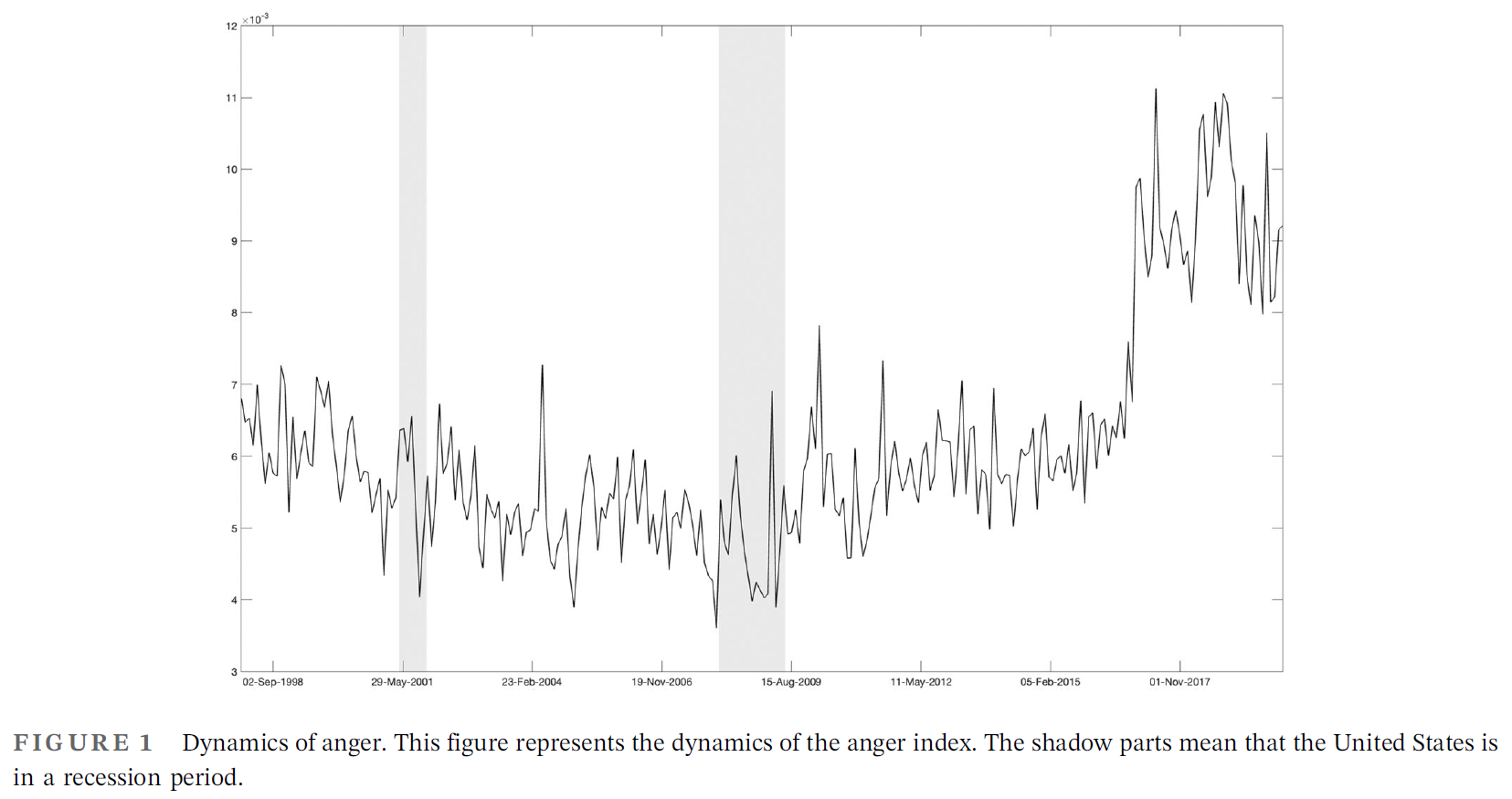

TRMI 愤怒指数(TRMI数据库)从0到1,表示提及anger和disgust时的平均得分。构建愤怒指数:

图1为愤怒指数时序,阴影条为NBER衰退,在1.19%左右波动。

相同方法构建:joy指数,fear指数,optimism指数,gloom指数。

其他变量:economic variables(Amit Goyal’s website),implied volatility index (NVIX),investor sentiment index($\color{blue}{Baker\ and\ Wurgler,\ 2006}$; $\color{blue}{Huang\ et\ al.,\ 2015}$)

In-sample predictive performance

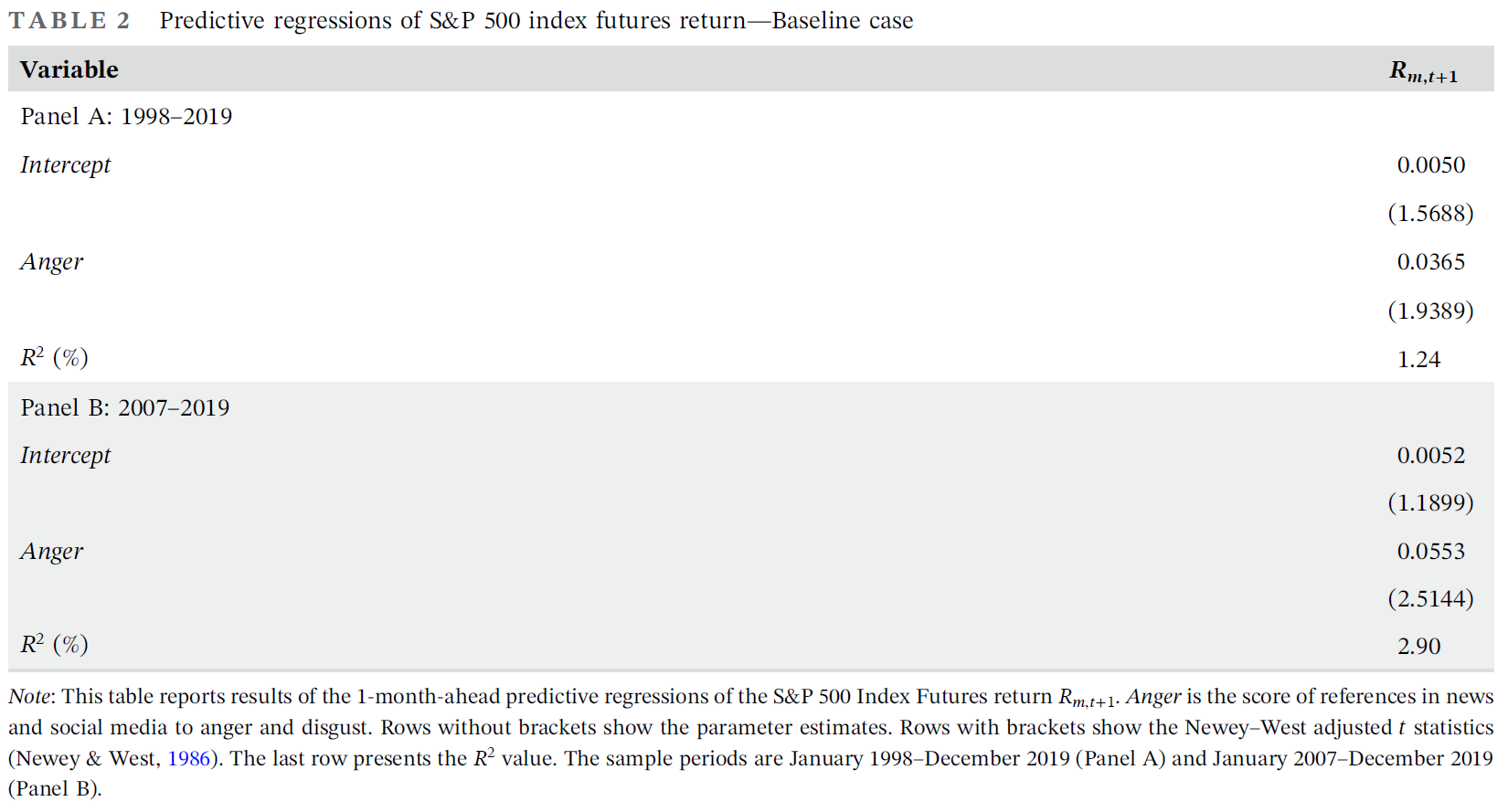

Baseline regression

正向($\color{blue}{Bodenhausen\ et\ al.,\ 1994}$)【愤怒投资者做出刻板的判断和考虑不周的决定,往往会对市场失去信心并反应过度,从而减少对股票的需求和持有量。而需求的下降将拉低同期价格,并导致指数期货的未来回报率更高。总体而言,愤怒的投资者需要溢价才能购买和持有指数期货,这意味着愤怒指数与随后的指数期货回报之间存在正相关联系】

Asymmetric predictive ability

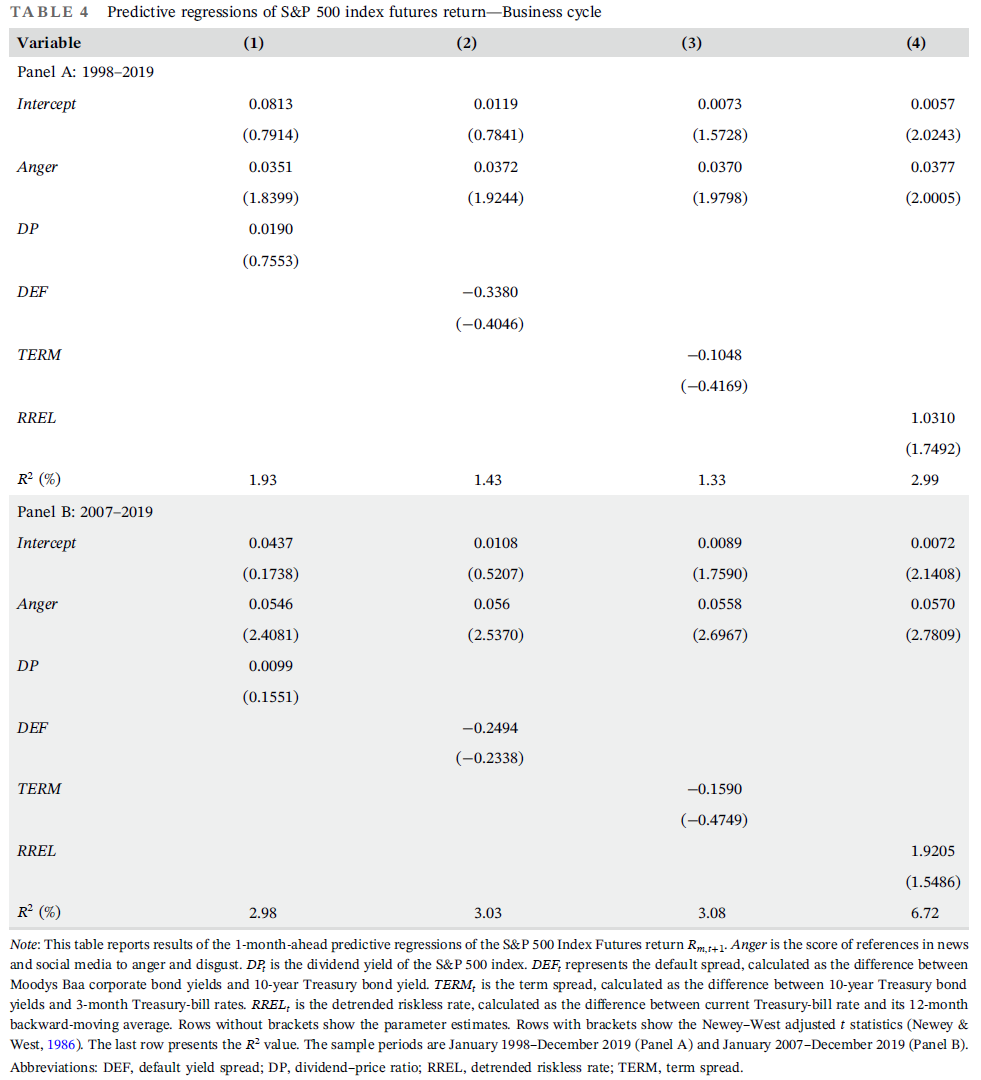

Controlling for business cycle

D/P, DEF, TERM, detrended riskless rate (RREL)

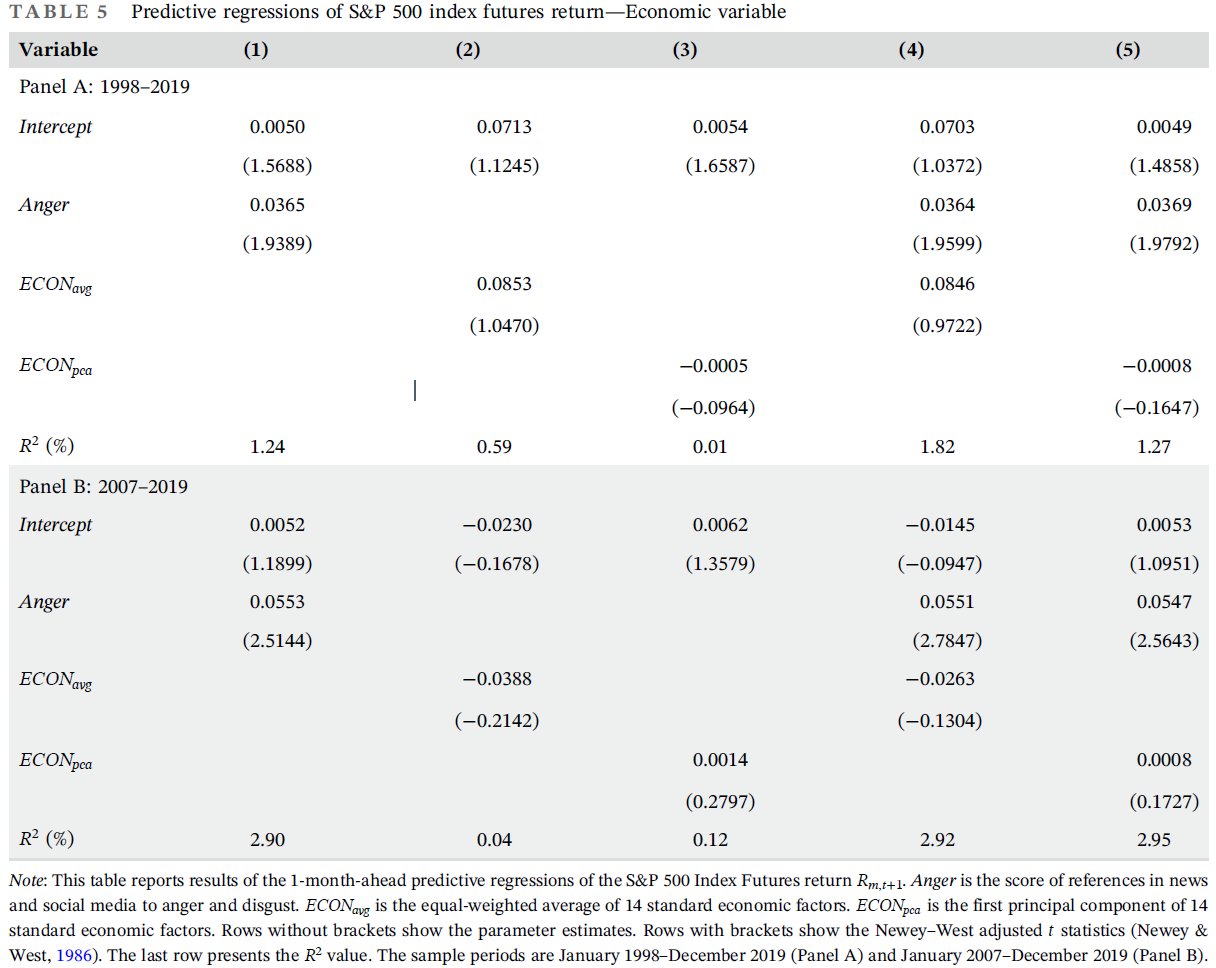

Controlling for economic variables

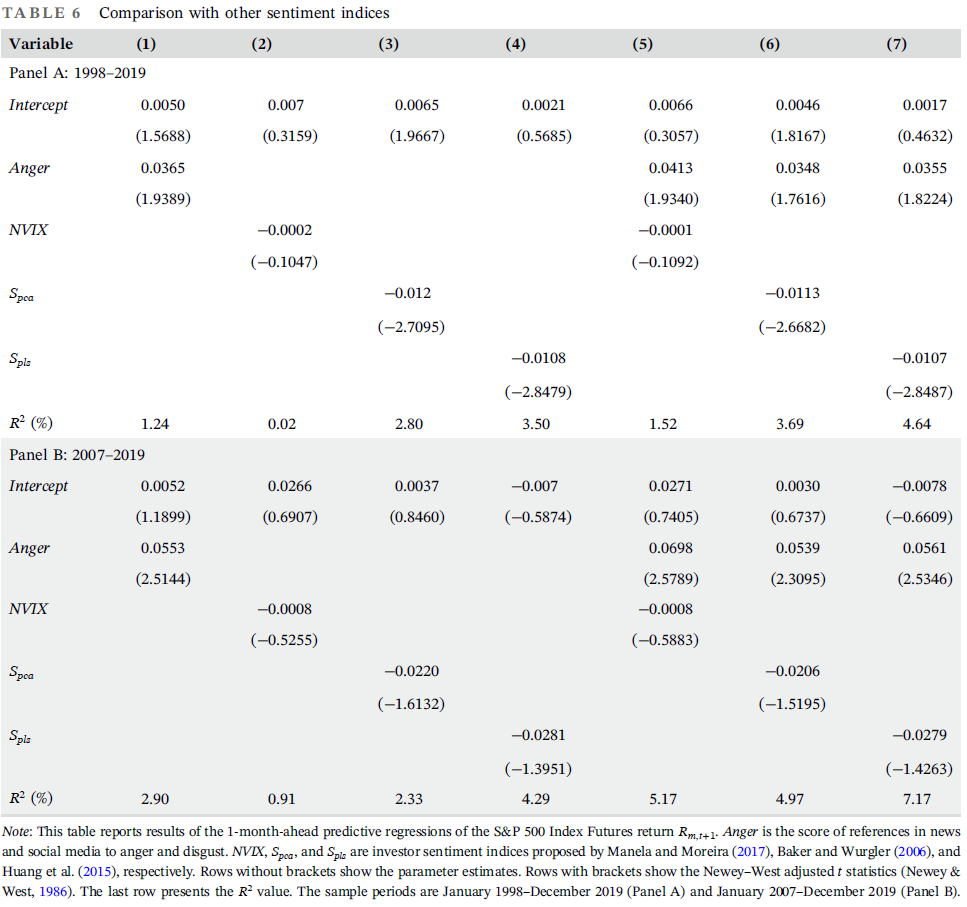

Comparing with other sentiment indices

Out‐of‐sample forecasting

Out‐of‐sample methodology

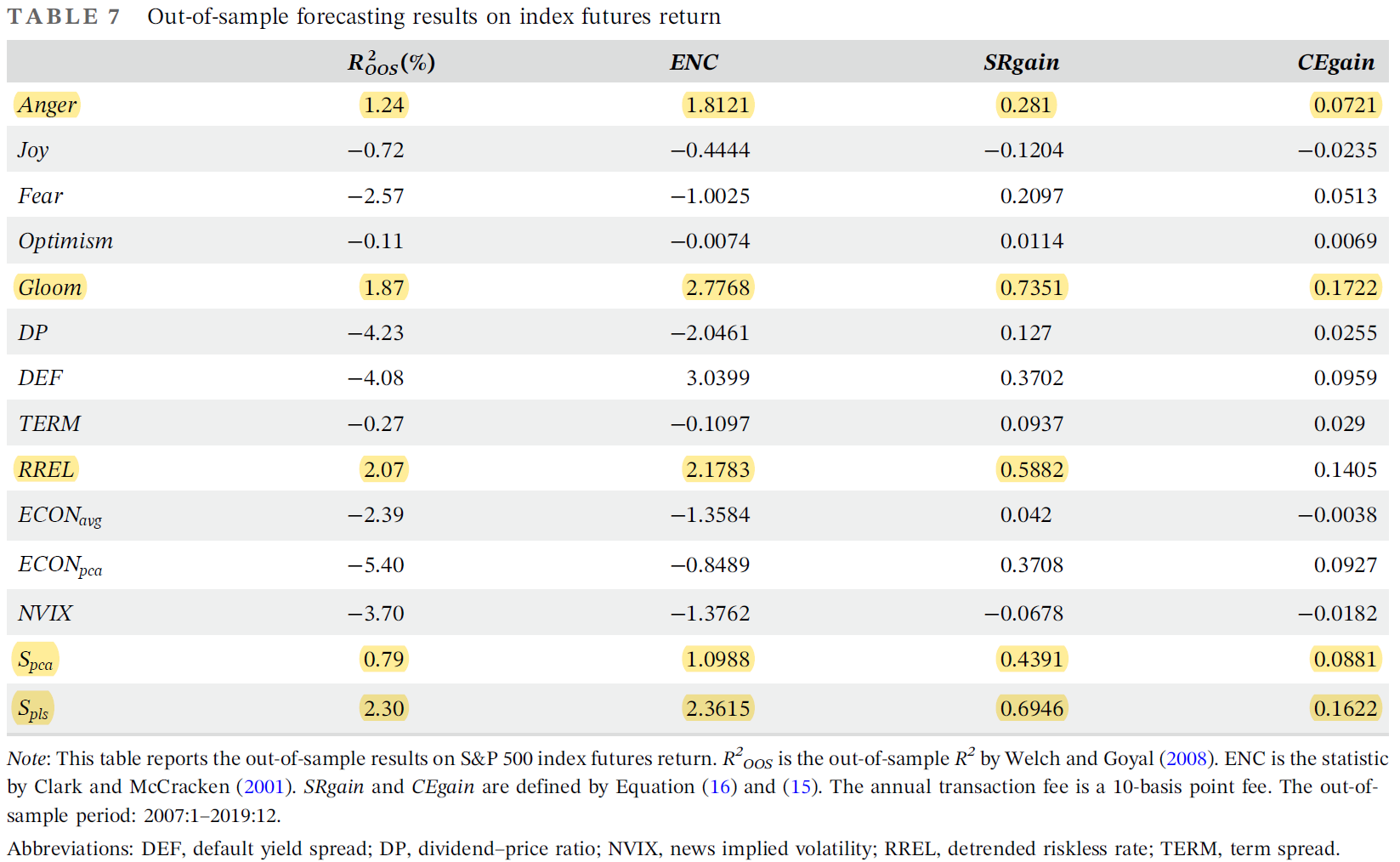

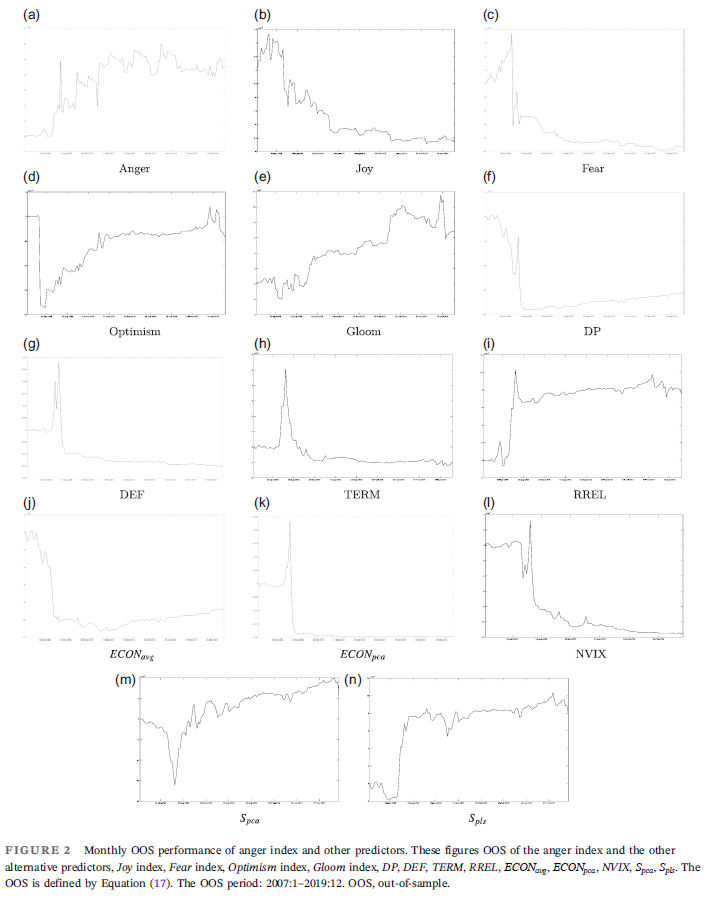

Out‐of‐sample forecasting performance

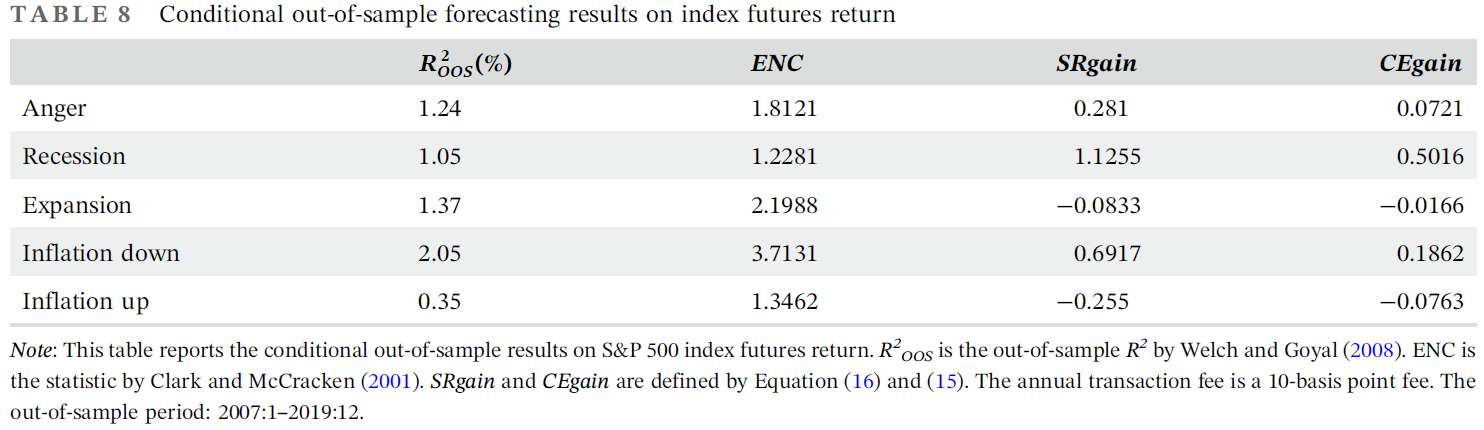

Conditional out-of-sample performance

Economic explanation

References

- Brown, G. W., & Cliff, M. T. (2004). Investor sentiment and the near-term stock market. Journal of Empirical Finance, 11(1), 1-27.

- Neal, R., & Wheatley, S. M. (1998). Do measures of investor sentiment predict returns?. Journal of Financial and Quantitative Analysis, 33(4), 523-547.

- Stambaugh, R. F., Yu, J., & Yuan, Y. (2012). The short of it: Investor sentiment and anomalies. Journal of Financial Economics, 104(2), 288-302.

- De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703-738.

- Manela, A., & Moreira, A. (2017). News implied volatility and disaster concerns. Journal of Financial Economics, 123(1), 137-162.

- Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross‐section of stock returns. The Journal of Finance, 61(4), 1645-1680.

- Huang, D., Jiang, F., Tu, J., & Zhou, G. (2015). Investor sentiment aligned: A powerful predictor of stock returns. The Review of Financial Studies, 28(3), 791-837.

- Bodenhausen, G. V., Sheppard, L. A., & Kramer, G. P. (1994). Negative affect and social judgment: The differential impact of anger and sadness. European Journal of Social Psychology, 24(1), 45-62.

- Griffith, J., Najand, M., & Shen, J. (2020). Emotions in the stock market. Journal of Behavioral Finance, 21(1), 42-56.

- Shen, J., Griffith, J., Najand, M., & Sun, L. (2023). Predicting stock and bond market returns with emotions: Evidence from futures markets. Journal of Behavioral Finance, 24(3), 333-344.

- Han, L., Wei, X., Yan, S., & Zhang, Q. (2022). Analyst rating matters for index futures. Journal of Futures Markets, 42(11), 2084-2100.

- Smales, L. A. (2014). News sentiment in the gold futures market. Journal of Banking & Finance, 49, 275-286.

- Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross‐section of stock returns. The Journal of Finance, 61(4), 1645-1680.